- Top

- Investor Relations

- Corporate Governance

Corporate Governance

Basic approach

Nihon Dengi’s basic approach to corporate governance is to contribute to the development of society through instrumentation engineering based on its management philosophy of setting ambitious goals, providing satisfaction to customers, and contributing to society at large, while simultaneously achieving sustainable growth for the Company and improving its corporate value over the medium to long term through transparent, fair, prompt, and decisive management. Our policy is to further improve corporate governance through appropriate collaboration with shareholders and all other stakeholders, proactive and fair disclosure of corporate information, improvement of the effectiveness of the Board of Directors, and engaging in constructive dialogue with shareholders.

Basic policy

1. Safeguarding the rights and equality of shareholders

We seek to establish an environment in which the rights of shareholders are substantively safeguarded and can be exercised appropriately, while paying due attention to the common interest of shareholders and adopting the necessary measures to ensure substantive equality among shareholders.

2. Appropriate collaboration with stakeholders other than shareholders

We recognize the existence of various stakeholders besides shareholders, including the Company’s customers, business partners, employees, and local communities. We seek to achieve sustainable growth and generate corporate value over the medium to long term through the promotion of appropriate collaboration with these stakeholders as well as initiatives aimed at addressing sustainability-related issues based on our management philosophy of providing satisfaction to customers and contributing to society at large.

3. Ensuring appropriate information disclosures and transparency

We conduct information disclosures with the basic policy of providing accurate information to all stakeholders, including shareholders and investors, in a timely, appropriate, and easy-to-understand manner in accordance with the relevant laws and regulations and our IR Policy.

In addition to timely disclosure documents, the information disclosed is also published in our Annual Securities Reports, Business Reports, Notices of the Annual General Meeting of Shareholders, Corporate Governance Reports, and on the Company’s website. Going forward, we will continue to ensure transparency through the enhancement of such content.

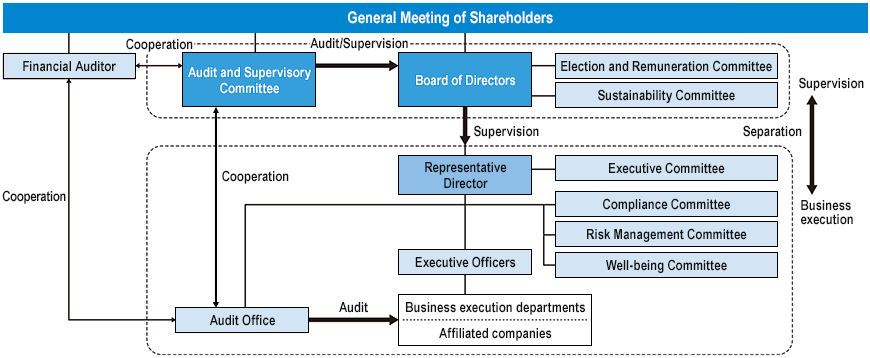

4. Responsibilities of the Board of Directors

We have opted to adopt the organizational design of a company with an Audit and Supervisory Committee. However, in the interest of greater management transparency and flexibility, we have decided to separate supervisory and executive roles by allowing important business execution to be delegated to the management team. In other words, the Board of Directors is primarily responsible for determining basic management policies such as medium-term management plans and for supervising business execution, while business execution is mainly the role of the Representative Director and President as well as other members of the management team, to whom decision-making is delegated.

In order to strengthen the supervisory function of the Board of Directors, we emphasize the use of independent outside Directors. Besides the statutory Audit and Supervisory Committee, we have also voluntarily established the Election and Remuneration Committee, an independent advisory body comprising all independent outside Directors as well as the Representative Director and President, to ensure that independent outside Directors are appropriately involved in and advise on audits, elections, remunerations, and other important governance-related matters. In addition, we ensure the independence of the Board of Directors and the effectiveness of its supervisory function by electing at least one-third of the entire Board of Directors from independent outside Directors with diverse attributes and backgrounds and who possess specialized knowledge in corporate management, finance/accounting, IT/DX, etc.

We have introduced an executive officer system under which the management team, led by the Representative Director and President and other executive officers, is engaged in flexible decision-making in line with the scope of their authority in the Company, including through resolutions of the Executive Committee and decisions by the President, to ensure prompt and flexible corporate management. In addition, when electing candidates for Directors by the Election and Remuneration Committee, we identify the business and management skills required for the management of an instrumentation engineering company to ensure the balanced composition of the Board of Directors as a whole.

We seek to maintain transparency and fairness in the remuneration of Directors (excluding Audit and Supervisory Committee Members) by adopting an incentive-type remuneration scheme consisting of fixed remuneration, performance-linked remuneration, and share-based remuneration, and by delegating the determination of the amount of remuneration for each individual to the Election and Remuneration Committee. Directors who are Audit and Supervisory Committee Members shall only receive fixed remuneration, with the amount of remuneration for each Director determined based on deliberations among Directors who are Audit and Supervisory Committee Members.

5. Dialogue with shareholders

In order to achieve sustainable growth and improve corporate value over the medium to long term, we endeavor to disclose information and respond accordingly based on our IR Policy to facilitate constructive dialogue with shareholders and investors. At the same time, we strive to enhance our systems and initiatives with respect to the formulation and announcement of management strategies and plans while making every effort to further mutual understanding with shareholders.

Overview of corporate governance structure

The Board of Directors (comprising seven Directors, including four Directors excluding Audit and Supervisory Committee Members and three outside Directors who are Audit and Supervisory Committee Members as of June 26, 2025) in principle meets once a month and additionally as necessary. The Board of Directors is primarily responsible for determining basic management policies such as medium-term management plans and for supervising business execution, while business execution is mainly the role of the Representative Director and President as well as other members of the management team, to whom decision-making is delegated.

The Audit and Supervisory Committee, which consists of three Audit and Supervisory Committee Members (Ichiji Kawamura, Fumiko Kishimoto, and Michihiro Kudo), meets once a month in principle. The Audit and Supervisory Committee monitors the status of internal audits and internal controls and audits the execution of duties by Directors, etc., by means of cooperation with the internal audit department and the Financial Auditor and on the basis of reports received from Directors who are not Audit and Supervisory Committee Members, etc. We have introduced an executive officer system in order to separate supervision from business execution, clarify the respective roles, and expedite decision-making, with executive officers playing a central role in business execution departments to ensure the thorough implementation of management policies, etc., resolved by the Board of Directors and to improve efficiency of business execution. Furthermore, in order to strengthen the transparency, fairness, and objectivity of procedures related to the election of candidates for Directors and the remuneration, etc. of Directors (excluding Audit and Supervisory Committee Members), as well as to enhance corporate governance, we have voluntarily established the Election and Remuneration Committee, which comprises all outside Directors (namely, Standing Audit and Supervisory Committee Member Ichiji Kawamura, Audit and Supervisory Committee Member Fumiko Kishimoto, and Audit and Supervisory Committee Member Michihiro Kudo; and chaired by Standing Audit and Supervisory Committee Member Ichiji Kawamura, an independent outside Director) as well as Representative Director and President Ryosuke Shimada, as an advisory body (the majority of whose members are independent outside Directors) to the Board of Directors.

Policy on the composition of the Board of Directors

In order for the Board of Directors to fulfill its roles and responsibilities (determination of basic management policies and supervision of management) and function in an effective manner, we have established the following policy regarding its composition.

1. Balance of skills

The composition should achieve a balance in terms of knowledge, experience, and abilities to ensure that the Board of Directors possesses the required skills in light of the management strategies, with the skills of Directors listed and disclosed in the form of a skill matrix.

2. Independence

At least one-third of the Board of Directors should be composed of independent outside Directors.

3. Size

- Audit and Supervisory Committee Members: Three to four (independent outside Directors in principle)

- Executive Directors: Up to six

- The overall size of the Board of Directors is determined by taking into consideration factors such as diversity, continuity of management, speed of decision-making, and separation of management from execution.

4. Diversity

- In order to deliberate on the appropriateness and risks of management strategies in an objective and multifaceted manner, and to supervise the execution of these strategies appropriately, the Board of Directors should be composed of a diverse range of human resources in terms of gender, work experience, age, etc., from within and outside the Company, while maintaining an appropriate size.

- Audit and Supervisory Committee Members elected as independent outside Directors should include at least one person with management experience at an external company, one person with sufficient knowledge of finance/accounting, and one person with knowledge of law.

Skill matrix

| Position | Independence | Name | Age | Skills, etc., of the Director | ||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Corporate management |

Technical | Sales | Business management |

Finance/ Accounting |

Law | IT DX |

||||

| Representative Director President |

― | Ryosuke Shimada | 56 | ● | ● | ● | ||||

| Director Senior Executive Officer |

― | Isao Okazaki | 59 | ● | ● | ● | ||||

| Director Senior Executive Officer |

― | Yoshiaki Kobayashi | 55 | ● | ● | ● | ● | |||

| Director Senior Executive Officer |

― | Katsuhiro Matsuura | 63 | ● | ● | |||||

| Director Audit and Supervisory Committee Member |

Independent Outside Director |

Ichiji Kawamura | 63 | ● | ● | ● | ||||

| Director Audit and Supervisory Committee Member |

Independent Outside Director |

Fumiko Kishimoto | 51 | ● | ||||||

| Director Audit and Supervisory Committee Member |

Independent Outside Director |

Michihiro Kudo | 65 | ● | ||||||

- Each Director fulfills the Company’s criteria for election. The balance between the areas of expertise, etc., of the Board of Directors is shown in this matrix.

- “Business management” includes compliance, risk management, HR management, sustainability, etc.

- A “●” mark has been placed next to the four main skills of each individual.

Criteria for election/dismissal of Director candidates

We have established the following criteria for the election and dismissal of Directors.

1. Criteria for election of Director candidates

- (1) All Directors

-

- (i)Directors must meet the relevant statutory requirements.

- (ii)Directors must be in good physical and mental health.

- (iii)Directors must have outstanding personal qualities, high ethical standards, and a law-abiding spirit.

- (iv)Directors must possess skills required by the Board of Directors in light of the management strategies, etc.

- (2) Executive Directors

- Executive Directors must possess extensive knowledge, experience, and connections in the instrumentation business and industry, or extensive specialized knowledge and experience in governance, internal controls, capital markets, finance and accounting, IT/DX, and other aspects of business management of listed companies, as well as the ability to execute the management strategies determined by the Board of Directors.

- (3) Directors who are Audit and Supervisory Committee Members

-

- (i)Directors who are Audit and Supervisory Committee Members must, in principle, be independent outside Directors who satisfy the Company’s “Independence Standards for Independent Outside Directors.”

- (ii)Directors who are Audit and Supervisory Committee Members must be able to provide appropriate advice, supervise all aspects of management and look out for conflicts of interest, and contribute to constructive deliberations at meetings of the Board of Directors by drawing on their knowledge, experience, and abilities in corporate management, finance/accounting, law, etc.

2. Criteria for dismissal of Directors

Any Director whose ineligibility becomes apparent in light of the “Criteria for election of Director candidates” shall be dismissed.

In addition, with regard to the procedures for the election or dismissal of Directors, the Election and Remuneration Committee, which has been voluntarily established as an advisory body to the Board of Directors and comprises all independent outside Directors as well as the Representative Director and President, shall deliberate on the election/dismissal of the Director, and the Board of Directors shall make a decision on the proposal for the election/dismissal in question based on reports from the Election and Remuneration Committee.

Independence Standards for Independent Outside Directors

We have established the following “Independence Standards for Independent Outside Directors” based on the independence standards set forth by the Tokyo Stock Exchange.

1. A Director will be independent if none of the following are met, at present and/or in the past five years:

- (1)A major shareholder (Note 1) of the Company or an executive (Note 2) thereof

- (2)An executive of an entity for whom the Company is a major shareholder

- (3)A major business partner (Note 3) of the Company or an executive thereof

- (4)An entity for whom the Company is a major business partner, or an executive thereof

- (5)A major lender (Note 4) to the Company or an executive thereof

- (6)A consultant, accounting professional such as a certified public accountant, or legal expert such as an attorney at law who receives a substantial amount (Note 5) of cash and/or other assets from the Company besides officer compensation

- (7)An entity who receives a substantial amount of donation from the Company, or an executive thereof

- (8)A person belonging to the audit firm that is the Financial Auditor of the Company, and who was engaged in or involved in the audit operations of the Company

- (9)A close relative (Note 6) of a person with respect to whom any of the aforementioned applies

- (10)Even in cases where a person could come under one of the above categories, if the person can be considered to be a suitable candidate for independent outside Director of the Company in view of his/her character, insights and other attributes, said person may be appointed independent outside Director of the Company on condition that he/she fulfills the Companies Act’s requirements for an outside Director and on condition that the Company provides a public explanation of the reasons that said person is considered to be a suitable candidate for independent outside Director.

2. A person who is not a close relative of a person who has within the past ten years been an executive of the Company

3. A person who has not been an executive of a subsidiary of the Company within the past ten years

4. A person who is not reasonably deemed to be incapable in other ways of fulfilling the duties of an independent outside Director

5. Total term of office of a person who currently serves as an independent outside Director should not exceed ten years to be reelected as independent outside Director

- (Note 1)“Major shareholder” shall mean a person who owns 10% or more of the total voting rights of said company, either directly or indirectly.

- (Note 2)“Executive” shall mean an Executive Director, Executive, or Executive Officer of a corporation or other organization, or a person or employee corresponding to such.

- (Note 3)“Major business partner” shall mean a customer for which the value of transactions with the Company in any of the most recent three fiscal years accounted for 2% or more of consolidated net sales of the Company or of the customer.

- (Note 4)“Major lender” shall mean a lender from which the Company had borrowed an amount equivalent to 2% or more of the total assets of the Company at the end of the most recent fiscal year.

- (Note 5)“Substantial amount” shall mean an amount of ¥10 million or more annually.

- (Note 6)“Close relative” shall mean a spouse or a relative within the second degree of kinship. The Board of Directors also selects as independent outside Directors persons who are able to provide appropriate advice, supervise all aspects of management and look out for conflicts of interest, and contribute to constructive deliberations at meetings of the Board of Directors from an independent standpoint by drawing on their knowledge, experience, and abilities in corporate management, finance/accounting, law, etc.

Elected outside Directors

| Name | Independent officer | Major concurrent posts | Reasons for election | Attendance at meetings in FY2023 |

|---|---|---|---|---|

| Ichiji Kawamura | ○ | - | Ichiji Kawamura has broad insights and a wealth of experience, including in corporate management. The Company judges him to be suitable as an outside Director as he has utilized his experience and insights in the auditing and supervision of Company management to provide appropriate advice and recommendations toward the improvement of the corporate value of the Company in the medium-to-long term. | Board of Directors meetings 11/11 (100%) Audit and Supervisory Committee meetings 10/10 (100%) (Appointed on June 26, 2024) |

| Fumiko Kishimoto | ○ | Azusa Sogo Law Office | Fumiko Kishimoto is deemed suitable to be elected as outside Director as she possesses deep insights and exceptional experience as an attorney at law and has hitherto put such knowledge and experience to use in the management and supervision of the Company to provide appropriate advice and recommendations for the improvement of the Company’s corporate value over the medium to long term. | Board of Directors meetings 14/14 (100%) Audit and Supervisory Committee meetings 13/13 (100%) |

| Michihiro Kudo | ○ | - | The Company has deemed that he is suitable to be elected as outside Director with the expectation that such knowledge and experience can be put to use in the auditing and supervision of Company management to provide appropriate advice and recommendations toward the improvement of the corporate value of the Company in the medium-to-long term. | Board of Directors meetings 14/14 (100%) Audit and Supervisory Committee meetings 13/13 (100%) |

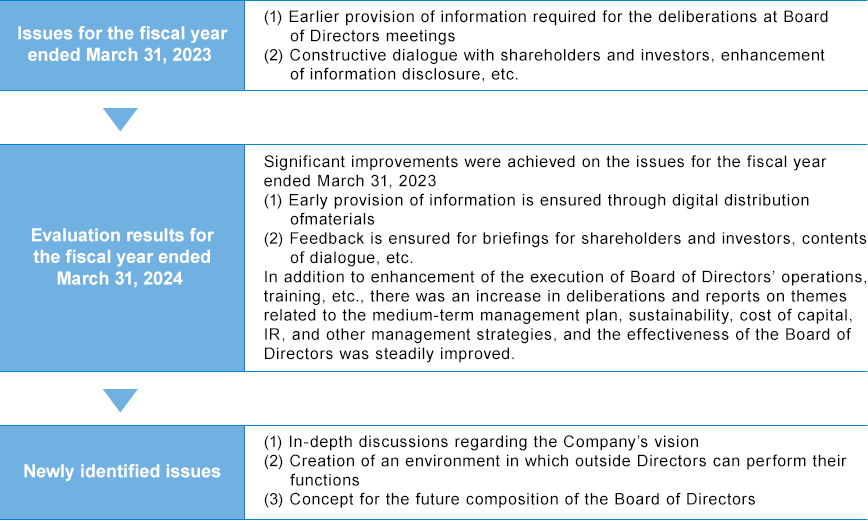

Evaluation of effectiveness of the Board of Directors

To ensure the effectiveness of the Board of Directors, the Company conducts an annual analysis and evaluation of the effectiveness of the Board of Directors based on self-evaluations by each Director and other factors. The evaluation process and overview of initiatives for the recent fiscal year (fiscal year ended March 31, 2025) are as follows.

Evaluation process

- Collection of completed questionnaires from all Directors

- Analysis of questionnaire results

- Deliberations by the Election and Remuneration Committee Based on an Analysis and Discussions by the Board of Directors

Overview of the initiatives

As a result of the aforementioned evaluation, the Company has determined that the effectiveness of the Board of Directors is appropriately safeguarded. We will continue to explore possible ways to improve the effectiveness of the Board of Directors, including by addressing the issues we have identified.

Corporate governance structure